5 essential considerations before you launch an NFT project

NFTs are unlike any product sold before. They’re a new asset class that isn’t physical and isn’t fungible. This means individuals, groups, and brands planning to launch an NFT project need to be aware of the regulations and rules surrounding NFTs, along with the risks that come with launching an NFT project. Discover the 5 key considerations you need to make before selling NFTs to set yourself up for success.

NFTs have hit the mainstream. With a massive $23 billion spent on NFTs in 2021, it’s no surprise why.

But this kind of money doesn’t get spent without a few issues. An asset class this big doesn’t just appear and boom without regulation, lawsuits, scams, and public backlash.

NFTs are a new technology and an entirely new type of product offering. This means people entering the NFT space need to understand the community of NFT buyers, as well as the regulation and laws surrounding the asset class.

If you’re a brand, individual, or group looking to launch an NFT collection, it’s crucial you understand these issues, and carefully consider a few key things before you release your NFTs to the public.

In the world of NFTs, the technology is moving much faster than the laws and regulation. But several NFT lawsuits currently taking place suggest new precedents may soon be set and new regulation developed:

- One unhappy NFT buyer is suing the seller for “misrepresented terms” after he spent over $500,000 on an NFT that was later released for free.

- Miramax is suing Quentin Tarantino after he announced he intended to sell the original Pulp Fiction script as an NFT.

- Nike filed a lawsuit against StockX for its sale of Nike sneaker NFTs.

Of course, regulations and rules around NFTs will vary by region, and this article is no substitute for proper legal advice. But this article covers 5 key considerations for the areas where NFTs depart from the sale of traditional products and services.

Don’t know anything about NFTs? Check out our NFTs explained for business blog before diving in.

The first key consideration concerns the intellectual property (IP) rights of your NFTs. It’s important the sale of NFTs comes with transparent information about precisely what buyers get for their money.

Some NFT projects, such as Bored Ape Yacht Club (BAYC), grant buyers ownership over the IP of the NFTs they purchase. This means people who buy the NFTs can use them in advertising, promotional materials, even in movies and music videos. This has led to many creative uses of the BAYC NFTs, including a band of “Apes” who’ve been signed to Universal Music Group.

RELATED: How NFT Ticketing Can Help You Engage Fans, Build Hype & Boost Sales

But for NFT projects like Disney’s Pixar Pals, giving the IP of Woody from Toy Story or Mike Wazowski from Monsters Inc. is not an option.

The rights buyers of Pixar Pals NFTs get is more like the rights they get when they buy a Pixar action figure. They own the action figure and can display it, post photos of it, or sell it on a secondary market, but they can’t reproduce or monetize its likeness.

For an example of what these rights look like, you can read the full terms of use for the marketplace where Disney’s NFTs are sold here.

These two examples are important to consider because if IP is granted with the purchase of the NFT it becomes a fundamentally different product. And sellers have an obligation to make this distinction clear to buyers.

Also, this should go without saying, but minting an NFT using someone else’s IP (their artwork, photography, likeness) without permission is a big no-go.

RELATED: 9 Steps for a Successful NFT Drop: Hype, Fairness & Fun

For small-scale NFT projects, there are a few simple financial considerations you need to make. For large-scale projects and major NFT businesses, the regulation is a bit more complicated.

Let’s start with the simple:

- If you make over a certain amount of money on your NFTs, you may need to register for a business license. Check your local laws surrounding sole trading and income.

- Selling an NFT you create is a taxable event, and proceeds from NFTs are typically considered income.

- This also applies to profits from NFT resale, especially if you work as an NFT trader or dealer.

Now, moving to the more complex.

If your NFT project expands beyond the standard sale of a digital asset, it can be subject to new regulatory scrutiny.

This occurs if an NFT is fractionalized, meaning divided into many fungible pieces that are put up for sale, or if the project is expanded to include its own currency, as BAYC, Sandbox, and Decentraland have done.

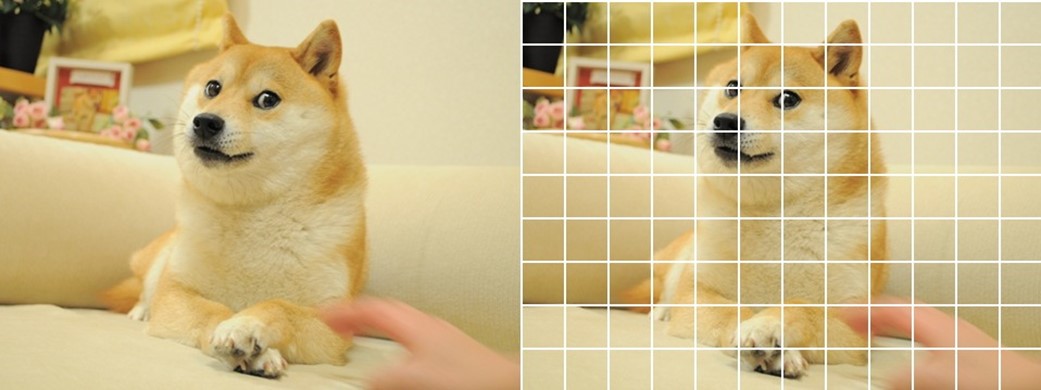

After buying the infamous Doge meme for $4 million, for example, its owner fractionalized the NFT into billions of tradeable pieces. These fractionalized pieces became their own type of cryptocurrency, called $DOG.

The Doge non-fungible token turned into many smaller fungible ones, meaning they can now be traded and transferred for other tokens of equal value.

Once you produce fungible tokens, you’re essentially selling securities, and you become subject to similar regulation to financial institutions. These include know your customer (KYC) complaince and anti-money laundering (AML) legislation.

KYC is a requirement for almost all financial institutions, from banks to stock brokerages to cryptocurrency exchanges. It’s used to prevent illegal activity like money laundering, funding of terrorism, and tax evasion.

NFTs aren’t currently regulated by KYC, but with the market growing fast, and concerns about scams and money laundering, many suspect they soon will be. And if your project expands to include fungible tokens, your project may be subject to a whole host of new regulatory requirements.

RELATED: 11 Exciting NFT Trends Shaping the Future of Non-fungible Tokens

The values of the Web 3 world are rooted in community, authenticity, and innovation. If you want your NFT project to make a real splash or grow, it’s crucial your NFTs are not only original, but your brand is authentic and transparent.

Early in the NFT hype, many brands released NFTs as PR stunts. While this worked at the time, and we’ve seen countless headlines about Pringles’ CryptoCrisps, TacoBell’s NFTs, and Charmin’s NFTP (Non-fungible toilet paper), these projects had little lasting impact.

The brands who are really succeeding with their approach to NFTs are those that are breaking new ground and embracing the community. Adidas did this perfectly with its high-profile collaborations and its tagline “with the community, for the community.”

If you’re a brand choosing to release NFTs as a one-off marketing stunt, consider using the publicity as a platform for a good cause. This is what Coca-Cola did, raising almost $600,000 to support Special Olympics International. If you’re already a big brand, you don’t want to be accused of using NFTs as a cash grab.

Accusations of cash-grabs were levied at several companies in the gaming world, where many fans believe NFTs will make gaming more expensive and less fair. Gaming giant Ubisoft received massive backlash after announcing they’d add NFTs to games, for example. And the S.T.A.L.K.E.R. game franchise even cancelled its NFT plans after the negative response from fans.

But being accepted by the NFT world is not just about being original, it’s also about being transparent and trustworthy.

In the decentralized world of NFTs, buyers want a level playing field. They want to know what they’re buying and what companies are up to behind-the-scenes.

The blockchain technology behind NFTs is perfect for this. It ensures transparency because all transactions are publicly available to anyone with enough time to look. This means you need to be open about giving NFTs to staff members or influencers, be transparent about how many NFTs you’re going to sell, and not try to mask any shady practices.

NFT consumers are digitally savvy. And with transactions publicly available on the blockchain, many NFT projects have been caught and exposed engaging in the NFT world’s version of insider trading.

Hear from Nifty’s VP of Marketing Jimmy Mouton why the transparency behind NFTs is so powerful and one of the key reasons he left Nike to work with NFTs.

RELATED: Nifty’s & Queue-it: How Major Brands Use NFTs to Drive Sales & Boost Loyalty

There’s a dark side to NFTs that’s well known and often discussed: their environmental impact.

While this dark side is not to be ignored, most NFTs today have about the same environmental impact as a Tweet or Facebook post.

Brands can offset emissions by using a carbon removal service or by choosing a blockchain that offers better sustainability.

The Palm blockchain, for example, uses 99.99% less energy than is required to mint an NFT on Ethereum Classic. And even that left over 0.01% of emissions is offset using carbon removal service Patch. Similarly, Flow boasts that minting an NFT with them costs less carbon than a Google search.

Even Ethereum, the most used blockchain for NFTs, recently upgraded to reduce the environmental impact of the tech. This upgrade—dubbed “the merge”—involves a new processing mechanism that uses 99.95% less energy.

So while it’s crucial your brand considers the environmental impact of NFTs before diving in, the technology has gotten to a point where brands no longer have to choose between sustainability and NFTs—they can have both!

RELATED: 39 NFT Ideas & Examples: The Wild, the Weird & the Wonderful

Generate hype, deliver fairness & set your NFT project up for success with your free 8-step interactive NFT drop checklist

When done right, your NFT drop will come with the double-edged sword of hype. NFTs tap into the power of scarcity marketing, and with so many projects offering massive ROI for consumers, a successful NFT drop will come with major hype.

Hype is a double-edged sword because on one hand it’s what every brand wants. It means more sales, more headlines, more social media discussions, more activity on resale markets, more potential partners who’ll be attracted to the project. Hype is the fuel that drives the engine of NFTs’ value.

But hype also brings high demand, and if you’re not prepared, high demand brings website crashes, bad bots, gas wars, and unfair shopping experiences.

Fairness is a key driver of trust. Customers’ perceptions of fairness drive 80% of reported trust in online retailers.

Building trust in your NFT project through fairness and trust is essential because NFTs are such a risky and speculative asset class.

Here are some key tips for ensuring a fair NFT drop:

- Set purchase limits (e.g. 2 per verified customer)

- Block bots using bot and abuse mitigation software

- Minimize gas fees with a virtual waiting room

- Ensure your site is prepared for high traffic

Fairness is a hot topic in the NFT space. With the NFT economy being community and creator driven, creating a fair NFT launch is an important way to show customers you care and your project can be trusted.

RELATED: How Major Retailers are using NFTs to Drive Sales & Boost Brand Loyalty

If you’re launching an NFT project, it’s important you don’t go in blind. For your project to succeed, you need to understand the landscape, regulations, and your intended audience. You need to:

- Know & decide how your NFT IP will work

- Be aware of financial regulation

- Be transparent, authentic & original

- Consider environmental impact

- Deliver fairness by blocking bots & reducing gas fees

Once you’ve made these considerations, you’re ready to plan your NFT drop. Check out our article with 9 steps for a successful NFT drop to learn how to make your NFTs stand out from the crowd, create a community around your project, and more.