What is NFT ticketing: 5 companies, 20+ examples & 7 opportunities for ticketers

NFT tickets are shaking up the ticketing industry. Ticketers are using NFTs to expand their product offering and customer base, build communities and fan engagement, and capture control over resale markets. Discover how and why ticketing companies, sports franchises, record labels, and festivals are embracing NFT ticketing.

What is an NFT ticket?

Like a traditional ticket, an NFT ticket gives its owner access to an event or experience. But instead of being printed off or stored on your phone, NFT tickets are stored on the blockchain. This makes them more permanent, secure, and dynamic than traditional tickets. NFT tickets unlock more revenue potential for ticketers, and more security, fairness, and fun for fans.

These benefits are possible because NFT tickets:

- Are irreproducible and can be verified as genuine on the blockchain.

- Can be used as “tickets” to additional experiences (e.g., online event recordings or an exclusive merch store).

- Can be combined with and linked to digital collectibles such as artworks or photos.

- Can have rules programmed into them (e.g., you can forbid transfer of tickets, or guarantee that 10% of any resale goes back to the creator).

- Can retain value and utility outside the context of access to an event.

Ticketmaster, Coachella, Live Nation, the NBA, the Olympics, and more have all embraced NFTs. And when you think about it, ticketing and NFTs are a natural fit. The two industries have a lot in common. Both tickets and NFTs are:

- Non-fungible: just like every NFT is unique, so too are tickets, since only one person can use their ticket to occupy their seat for an event.

- Limited in supply: just as NFTs are released in limited batches, all live events offer a limited quantity of tickets to customers.

- Bought & sold on secondary markets: limited-supply and non-fungibility are a recipe for a resale market, meaning both industries face bots and resellers trying to exploit demand.

- Tied to industries with the most intense fandom, merchandising, and collectibles: industries like music, sporting, and cinema.

Tickets, memorabilia, and merchandise have been high-value collectibles for years—NFTs just bring these into the digital realm.

Discover how NFT tickets are creating opportunities for growth, community building, and increased control in the ticketing industry. Get inspiration from the leading NFT ticketing examples and companies and learn how NFT ticketing expands not just what a ticket can be, but also your total addressable market and ability to engage fans.

Don’t know anything about NFTs? Check out our NFTs explained for business blog before diving in.

Discover how NFT tickets enable:

- Turning tickets into assets & collectibles

- New forms of merchandise

- Community-building & fandom

- New & unique fan experiences

- Event opportunities in the metaverse

- Control over resale markets

- New revenue streams for artists & ticketers

Generate hype, deliver fairness & set your NFT project up for success with your free 8-step interactive NFT drop checklist

People have collected ticket stubs for a long time. They’re mementos of an experience. While you probably won’t save your used bus tickets to remember the trip to work, many people save tickets from significant moments they want to preserve and remember.

Their first sporting event. The first time they saw their favorite artist live. Their once-in-a-lifetime music festival experience.

These tickets sit in drawers and on people’s fridges and are often deeply personal—but some are also very valuable.

If you want a ticket from Michael Jordan’s first NBA game, it’ll set you back $468,000. A ticket from a Beatles concert is worth about $16,500. Ticket stubs from the first ever Woodstock are selling for $1,000.

These tickets aren’t just personal memories, they’re cultural memories. Which is another way of saying they’re a part of history.

Ticketing companies tend to see tickets as the “ticket” to an experience to be used before that experience occurs. But many of the billions of tickets sold worldwide each year are actually used by people to represent experiences after they occur.

One of the main forays into NFTs from companies like Live Nation and Ticketmaster is built on this change of perspective. The experience doesn’t end after the event ends. The ticket isn’t thrown away once it’s used.

NFT tickets let fans fill their digital wallets up with NFTs of memories, events, and experiences. They make holding onto and preserving tickets easier. As Live Nation Entertainment President and CEO Michael Rapino said of their Live Stubs venture:

“Our Live Stubs product brings back the nostalgia of collecting ticket stubs while also giving artists a new tool to deepen that relationship with their fans and we can’t wait to see what the creativity of this community dreams up as it grows.”

As Rapino indicates, turning NFTs into collectibles doesn’t just digitize the old-fashioned methods of ticket collecting—it offers many more unique benefits, which we’ll get into shortly.

RELATED: 9 Steps for a Successful NFT Drop: Hype, Fairness & Fun

The connection between NFTs and tickets goes beyond just the concept of NFTs as tickets. Many organizations are already using NFTs as a new form of merchandise.

Queue-it’s CEO and co-founder Niels Henrik Sodemann recently told Ticketing Business News:

“We believe that one of the biggest changes we’ll see in the industry over the next five years is the increase of digital components in the ticketing revenue stream. A great example of that is the combination of ticketing sales with NFTs.

“The value created for customers would be two-fold: getting to attend the live entertainment experience itself, and an exclusive and personal digital asset.

“Gone are the days of autograph albums and t-shirt tables. With concerts, you could imagine the allure of trying to hold on to that experience once it’s over by either possessing the video of your favorite song, a personal signature from the artist, or a unique artist/tour/city commemorative.”

There are numerous examples of event organizers using NFTs in precisely this way—to expand their product offering and customer base through digital merchandise and unique collectibles.

NFT ticketing examples:

- WarnerMedia’s DC Comics gave out comic book NFTs along with tickets to their DC FanDome event.

- Coinbase integrated NFT merchandise into the Governors Ball Music Festival in New York, giving its users a free, one-of-a-kind NFT which also granted access to the VIP lounge.

- South by South West (SXSW) embraced NFTs throughout its festival, perhaps the most notable of which is the release of SXSW NFTs as merchandise.

- Coachella created its own NFT marketplace, selling artwork, photos from the event, and lifetime pass ticket NFTs.

- An NFT of Andy Murray’s Wimbledon 2013 win included two VIP tour experiences and Centre Court tickets to the Wimbledon Gentlemen’s Final 2022, as well as a 30 minute game of tennis with Murray himself.

- DJ 3LAU created a series of experiences that let people gather tokens that could be used for real-world purchases at his Our Music Festival.

- Major NFT brand Bored bored Ape Yacht Club holds exclusive events for NFT holders, including yacht parties, concerts, and art shows.

- Many live events now offer proof-of-attendance-protocol (POAP), which is an NFT that proves you were at the event and can unlock benefits in the future.

- Pop artist Pip released a series of NFTs that doubled as backstage passes, lifetime passes, and access to unreleased content.

- AfterParty hosted an NFT-gated music and art festival in Las Vegas with major artists and over 6,000 attendees.

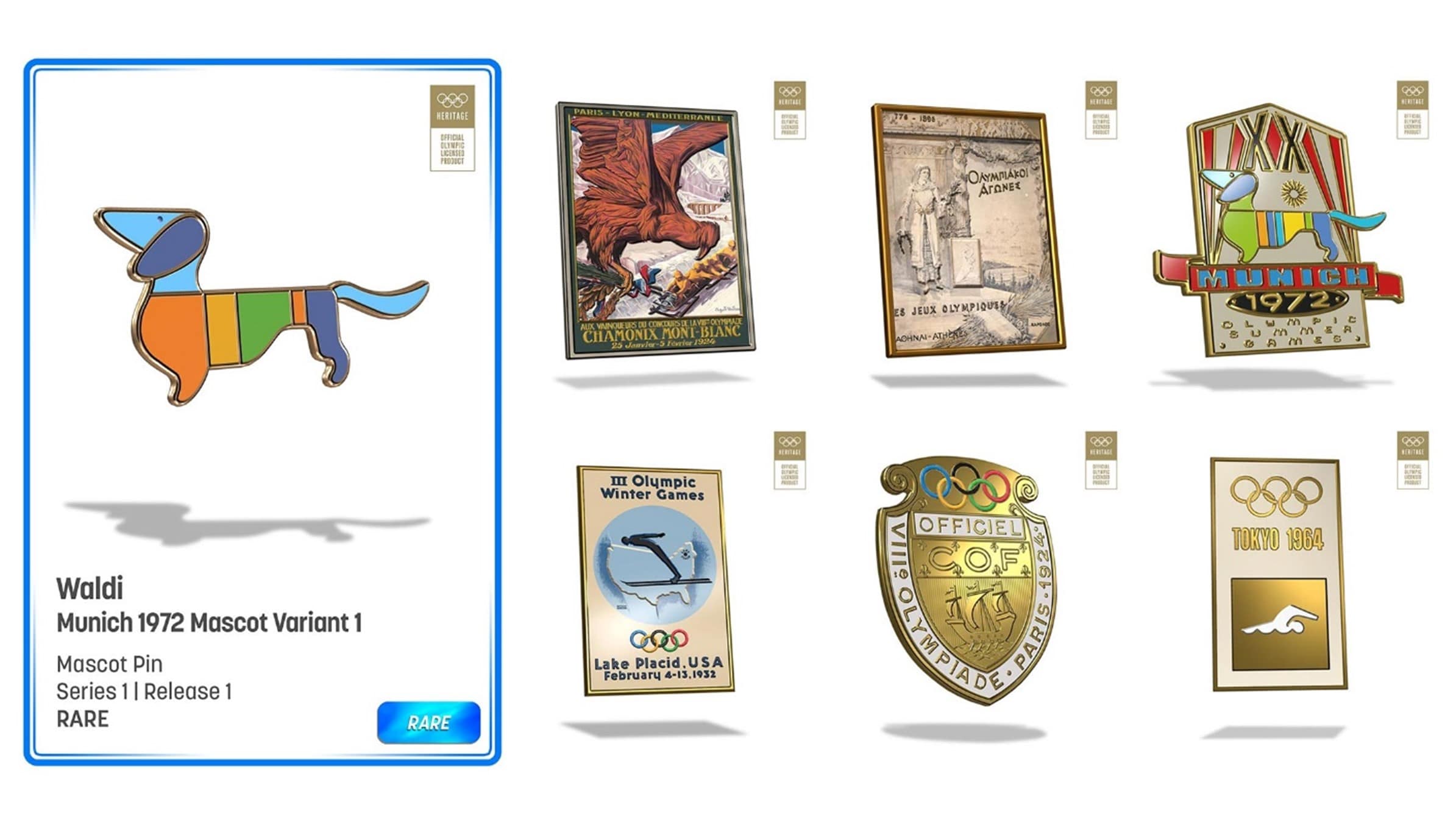

- Even institutions like the Olympics are releasing NFT merchandise, with their own series of NFT pins and moments from Olympic history.

For many of these organizations, NFTs offer a low-cost, scalable way to deliver merchandise to fans around the world.

Unlike traditional merch like t-shirts and caps, organizations can create different levels of rarity and value by price-tiering their NFTs in a granular way. Coachella’s NFTs, for example, ranged in price from $40 to $270,000.

But it’s not just organizations making NFT merchandise. Athletes, musicians, actors, and artists are also getting in on the action, with everyone from Tom Brady to Snoop Dogg to Damien Hirst to Johnny Depp releasing their own NFTs.

RELATED: 39 NFT Ideas & Examples: The Weird, the Wild & the Wonderful

NFTs are a powerful tool for generating communities. Pick any mid-sized NFT collection and take a quick look on Twitter and you’ll see NFT buyers are among the most vocal and community-oriented customers out there.

Thousands of Twitter users make their NFTs their profile pictures. They connect and follow one another. They retweet and like announcements from creators and community members. They voluntarily promote the project they’ve bought into and become loud brand advocates.

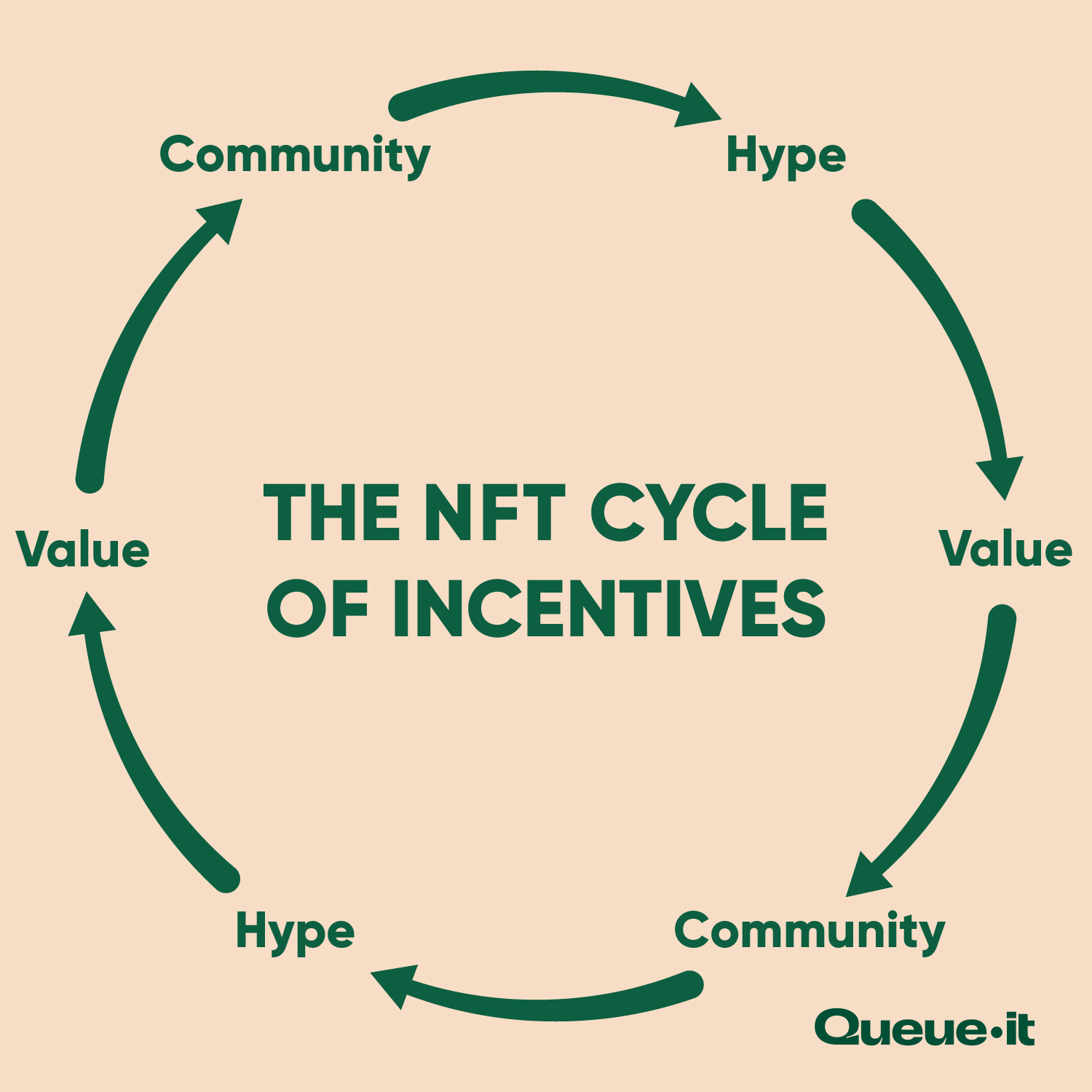

There’s several reasons NFTs create brand advocates. But one of the biggest is that NFTs as an asset class incentivize self-promotion and community building.

NFT collections represent both an investment and a membership to an exclusive club of owners. And the more desirable membership to that club becomes, the more highly valued the investment becomes.

This creates a powerful cycle of incentives.

Take VeeFriends as an example. Created by influencer Gary Vaynerchuk, each VeeFriend NFT doubles as a ticket to an exclusive conference called VeeCon.

When VeeFriends first released, around 10,000 were sold in an auction for between $1,500 and $50,000, depending on the level of rarity and the perks the NFTs came with.

The initial buyers were extremely passionate about the project. They changed their profile pictures, Tweeted about it, followed other ”VeeFriends”, and built both private and public communities around the NFT collection. Just tweeting #VeeFriend along with a picture of your VeeFriend NFT would attract hundreds of followers and conversations.

As others became interested in the project and existing owners decided they weren’t willing to give up their membership cheap, the price of the VeeFriends NFTs rose.

As the price rose, those who didn’t care enough about the project or weren’t interested in attending VeeCon sold their NFTs at a profit, allowing new members to buy in at a higher price. Of course, these new members believed in the project, so they became fervent advocates of it and the price rose again.

VeeFriends price history

Today, VeeFriends boasts the largest NFT Discord of any project, with almost 400,000 members. Over 52,500 ETH (approx. $147 million) worth of VeeFriends have been traded. And the first VeeCon boasts speakers like Snoop Dogg, Beeple, Mila Kunis, Eva Longoria, Pharrell Williams, Deepak Chopra and many, many more.

As you can see, the hype and community drove the increase in value, which drove more hype and community, which drove more value, which...you get it.

It’s a speculative market, but the market makers aren’t on Wall Street pulling the strings. They’re on Twitter, Instagram, and Discord. NFT customers are incentivized to do what marketing teams spend millions on: boost the visibility, desirability, and level of engagement with the brand.

When done right, NFTs offer the opportunity to turn fans into advocates, and to let those fans benefit when they raise the profile of your project and brand. It’s the decentralization crypto enthusiasts are passionate about creating a new form of community-driven marketing.

Many NFT companies have already shown this powerful cycle of incentives can work, which is why ticketing organizations, celebrities, and marketers are looking to replicate it through their brands and events.

Hear from Nifty’s VP of Marketing Jimmy Mouton the power and importance of community building with NFTs.

The opportunities for NFT ticketing expand when you realize the NFTs aren't just a one-off ticket. They can be a membership to an exclusive community. A collectible with utility and benefits reaching beyond the event to which it grants access. A rewards system for loyal fans and valuable customers.

We see this in the VeeFriends example above, but also with other major NFT projects.

The NBA has done probably the best job of engaging fans with new NFT-powered experiences out of any live event organization. There’s been over $800 million worth of NBA Top Shot NFTs traded. For a sense of scale, that’s more than half the $1.5 billion they make on ticket sales for an entire season.

And what's the NBA is selling as NFTs?

Clips from games that are already publicly accessible. Moments they broadcast for free on TV. Highlights they were putting on YouTube anyway.

The NBA realized they could offer fans an entirely new way to engage with their brand by selling moments from NBA history as NFTs. Forget trading cards and Fantasy Basketball—what’s more exciting than owning a game winning Lebron James dunk?

For ticketers, artists, and athletes this is a game-changer, both in expanding your product offering and in giving fans new ways to engage with your brand.

You could sell videos and photos from a concert or festival.

You could offer NFTs which give buyers first, invite-only access to future ticket releases.

You could offer lifetime passes, like Coachella and the Kings of Leon have done.

You could create a rewards-based program or video game, like the Olympics has.

You could partner with an NFT brand and offer an exclusive experience, like SXSW did with NFT brand Doodles.

The key benefit of these new ways to engage fans is not just delivering new experiences for people who are already attending events, but expanding the reach of your brand beyond the locale of the live event. As Ted Leonsis, owner of the Washington Capitals NHL team, said:

“What if [the Caps were] selling a ticket along with a memory of the night Alex [Ovechkin] scores his 717th goal? Now, people in Russia are buying. They’re [keeping] the memory and then reselling the actual ticket entry into the business. [Our] TAM [total addressable market] is the world—not just people who are Caps fans who want to come to that game.”

NFT ticketing companies

- YellowHeart: An NFT ticketing company focused on smart tickets, digital memberships, digital communities, and gated access media.

- GUTS: A smart digital ticketing service using GET Protocol to deliver “honest ticketing” by giving organizers more control, eliminating fraud, and giving fans exclusive benefits.

- Seatlab: An NFT event ticketing marketplace focused on connecting artists with fans, eliminating fraud, and delivering fairness by minimizing scalping.

- DeFy Tickets: An NFT ticketing software that allows artists and event organizers to avoid fraud and scalping while capturing a share of the multi-billion dollar secondary market.

Generate hype, deliver fairness & set your NFT project up for success with your free 8-step interactive NFT drop checklist

During the pandemic, the digital event industry grew faster than ever. And while these digital events were being held, many ticketers had the same realization Leonsis had about NFTs and his Hockey Team: digital events are scalable in a way live events can never be.

RELATED: Will Online Streaming Reshape the Future of the Ticketing Industry?

Live-streaming events is nothing new. What is new is the creation of immersive, interactive online experiences that anyone in the world can participate in—what’s new is the metaverse.

In 2020, a virtual Travis Scott concert on metaverse game Fortnite attracted 27.7 million unique players to attend—making it the biggest concert ever. That’s in addition to the 187 million views it’s clocked up on YouTube. It was scalable in a way live events aren’t, but also immersive in a way traditional TV and streaming isn’t.

Gartner predicts the global metaverse market will hit nearly $42 billion by 2026, and 25% of people will spend an hour a day in the metaverse by then. Active metaverse users increased 10x between 2020 and June 2021, and those numbers are only set to rise.

What does this have to do with NFTs?

In most new metaverse games, the in-game products are NFTs. NFTs are the property or venue in which concerts take place, they’re the tickets for entry into the concert, they’re the limited-edition merchandise fans take with them when they leave, they’re even the highlight clips and best moments from the event.

That’s why Warner Music Group bought a massive concert venue as an NFT in the Sandbox metaverse. If virtual events like this continue to grow in popularity, Warner’s NFT purchase has secured a place to host artists, sell merchandise, and bring fans together.

Universal Music Group is also taking a bet on the metaverse as a new frontier in entertainment, bringing their artist Jamiroquai into Sandbox with immersive concerts and games.

Rachel Redfearn, SVP A&R and Brand Management of Universal’s Bravado said:

“We are delighted to be able to deliver a new method of interaction between artists and their fans and cannot wait to welcome you all into the world of Jamiroquai with The Sandbox.

“Through new partnerships, we can help our artists deliver content, commerce, and creativity to fans directly, as fully immersive, and innovative experiences.

“Both Bravado and Universal Music Group are excited to help fans explore the metaverse, alongside their favorite artists, and for the infinite possibilities it will open for fans to more deeply engage in an artist’s vision.”

Ticketing, perhaps more than any other industry, is constantly battling resellers and bots looking to profit off a mismatch between supply and demand.

And while it’s important ticketers do everything they can to prevent this exploitation from taking place—including virtual waiting rooms and bot mitigation software—the battle against bots and resellers isn’t one that can be easily won.

RELATED: Everything You Need to Know About Ticket Bots

Smart contracts—the technology behind NFTs—show promise for helping in this fight.

Smart contracts automatically execute, control, or document specific events. This means ticketers can code NFT tickets (through the smart contracts behind them) to have a maximum price they can be resold for, or block transfers of ownership, or automatically send a portion of the resale price back to the original owner.

The documentation of NFT creation, ownership, and transfers of ownership on the blockchain also eliminates ticket fraud. When customers are buying NFT tickets on a secondary market, they can trace the ticket back to its original creator to verify its authenticity. This documentation can also be used by your organization to capture valuable data on resale trends and demand.

There are many things that can be done with smart contracts, but one of the key ways they’re being used is for creators to capture their portion of the resale market.

Today, many NFTs have a royalties function built into their smart contract. What this means is when the NFT is sold on a secondary market, the smart contract will automatically execute code sending 10% of the resale value back to the creator of the NFT and document the transfer of ownership.

Capturing a reliable cut of the resale market would already represent a significant boost to the profits of ticketing companies. But what NFTs fundamentally enable is an expansion of the notion of what a ticket is and what it can be. They expand your product offering and your total addressable market.

Coachella sold 10 lifetime pass ticket NFTs for $1.5 million, with one of the tickets going for a massive $270k. That’s the equivalent of almost 3,500 of their regular tickets sold in one batch to just 10 people.

Over $800 million has been traded on NBA Top Shot’s NFT marketplace.

NFT sports collectibles sold on DraftKings have raked up $44 million in revenue for the sports betting company.

And when just about every major player in the live event industry—from artists to record labels to sporting franchises to ticketing giants—are dabbling in NFTs, you can be certain it’s not because they expect to lose money.

One exciting NFT use case by ticketing company Open offers the opportunity to pre-finance live events using NFTs. The ticketer or creator can draw on their fans and community to collect funds that can be used to pay for the event ahead of time.

It’s a decentralized form of crowdfunding and event organization. If an artist can convince 1,000 fans to buy $50 NFT tickets through pre-financing, they suddenly have $50,000 with which they can organize the event, as well as a guaranteed 1,000 tickets sold before they even confirm a venue.

This creates exciting new opportunities, such as letting the fans vote on the venue or the date, or releasing an additional, say, 2,000 tickets to the public for a higher price than the pre-financed NFT tickets. This would enable those who invested in the project early to sell their tickets at a profit.

NFTs are shaking up ticketing. They’ve already been embraced by artists, athletes, and actors, and are quickly making their way into the business models of huge ticketing and live event players like Ticketmaster, LiveNation, Coachella, the NBA, and more.

NFTs offer the ticketing industry opportunities for growth, fan engagement, and increased control. NFT ticketing expands not only what a ticket can be, but also your total addressable market. With NFT tickets, you can:

- Turn your tickets into NFT collectibles that can be traded on secondary markets

- Sell videos, photos, and digital merchandise from your events as NFTs

- Offer NFTs which give buyers first, invite-only access to future ticket releases

- Create active communities and encourage fan engagement with NFT-powered experiences

- Hold immersive digital events where NFTs are the venues, the merch, and the tickets for access

- Offer lifetime pass NFTs for your live events

- Create a rewards program or video game that uses NFTs as incentives

- Partner with an NFT brand to offer exclusive experiences

- Ensure you get a cut of the ticket resale market

- Pre-finance events to ensure profitability and involve fans in the process

These are just a few of the many existing applications of NFTs in ticketing. And with the uptake of NFT technology growing fast and many companies and passionate individuals working hard to innovate, these applications and opportunities are only set to grow.